While I have paused new blog posts until the Fall (coming up with new material), I recently had an opportunity to speak with a colleague into what is evolving as the most promising growth area in the gaming space, casual gaming. Barak David, CEO of Murka Games, chatted with me about an often neglected sector in the gaming space that has helped fuel Murka’s recent growth.

Lloyd: Hi Barak, thanks for joining me today, excited to be speaking with you. First, congratulations on the success Murka is enjoying, it is quite exciting. I was hoping today to talk about an area of the gaming space that you recently expanded into, Casual. Would you mind explaining exactly what are casual games and why you expanded Murka’s business into this area?

Barak: Hi Lloyd, happy to be here and speaking with you! Murka traditionally has focused on social casino games like slots and poker. When I joined Murka a couple of years ago, I realized we had great talent, experience, and knowledge at the company. While investing more to expand in social casino, I was confident we could diversify into other areas and appeal to more gamers based on our knowledge.

Lloyd: Why casual? And what are casual?

Barak: Casual games are a very wide segment of the business that is divided into many sub-segments like cards, puzzle, match-three and more. They are often skills based games with a very wide audience. Casual games are fast to develop and will offset the “less strong” points for a traditional social casino company.

We choose at Murka to focus on simple and fun puzzle, words and cards games that are based on advertising monetization and have a very wide audience, the perfect match for us.

Lloyd: Interesting, how are these games different than what would be considered hyper-casual?

Barak: Hyper-casual is an interesting genre; the difference is in the idea to execution. Hyper-casual games are lightweight games with relatively simple game play and mechanics, while casual games are more long term games (they often have a player lifetime of over a year), they have a stronger and longer game loop. Hyper-casual games are built without a specific audience, different from casual and other genres. another very important point, most of the hyper games have very short lifetime

Lloyd: Why did you decide to go with casual instead of hyper-casual at Murka?

Barak: The jump from making a social casino to casual was not trivial but better suited to our skillset than hyper-casual. Compared to other companies, we started by doing it organically. The change in the mindset from social casino, which takes a year to develop and has a very long lifetime, to hyper-casual is too big. Moreover, from the sustainability of the business, it’s much better to have reliable casual games that continue growing than short term hits with hyper casual. Also, in my industry experience, I am much more confident about casual continuing its huge growth trajectory.

Lloyd: So in Murka’s case, what type of games have you built and plan to build? You said earlier that the category is broad, how are you attacking it?

Barak: When entering the space, we did market research, looked at trends, and established a casual innovation group internally to decide what concepts to try initially. Currently, we are very strong in the card game genres (solitaire) with more interesting products that will soon be introduced. We have also been very successful with word games (a great educational and fun experience for the players) and Tetris/Sudoku games that are fun to play anytime. As we are learning and gaining more, we are expecting to introduce more and more games.

Lloyd: Going into a little more detail on the games, how many people do you usually need to build a game, how long does it take and do you leave a Live Services team (or person) on after launch?

Barak: That depends on the technology you are using and the complexity of the game. At Murka, we have built a very strong and scalable platform that we base all the casual games on. This platform helps us use the same modules in different games and dramatically improve the time to market. This gave us a possibility to release four casual games in different genres in the last six months.

So, to answer your question, from idea to execution 6-8 weeks and, yes, we continue to improve the games until a level we believe our players have a greater game experience.

Lloyd: That brings me to my next question, how do you make money with casual games? Is the business model the same as social casino?

Barak: The business model is very, very different. You start with different and unique UA techniques and much lighter monetization comparing to social casino or core games. Moreover, in Murka we decided to focus on advertising monetization rather than in-app purchases.

Lloyd: So most of the revenue comes from ads?

Barak: Yes, this is not always typical for casual but that was the decision we made when entering the space.

Lloyd: That makes sense, have your results confirmed these expectations?

Barak: Absolutely, I can say that from the moment we started to invest in the casual in a professional way and developed in-house knowledge we see very strong results and quick paybacks. For example, the DAU of our casual games has grown 15X since the beginning of the year.

Lloyd: What has surprised you most about the space?

Barak: That’s a very good question. I was very confident about trying to get into this market but it was not always easy to onboard everyone with the idea. Wehad so much success with social casino, it is hard to justify creating a second vertical. For me, it was very good to see how quickly we developed an expertise and learned how to create more and more games based on the same set of rules.

Lloyd: I remember I was one of those skeptics. would you doing anything differently knowing what you know today?

Barak: Maybe start even earlier 🙂 but mostly I think we build this activity step by step, create good games and expertise and confidence and after start ramping up. Overall, I’m very happy with what we have done and how we have accomplished it.

Lloyd: Would you recommend focusing on more games fast or spending a lot of time on a few games?

Barak: That is the question we debate all the time, on one hand if you have a very strong and scalable game you should focus on it and grow it. On the other side, do we want to have several titles and diversify, decreasing the risk and then scale more by number of titles.

It also depends on the capacity of the team, so I would say that need to judge every case separately by himself but my intuition suggests diversification.

Lloyd: Along those lines, have you found in casual that the games you expected to work have been your best performers or are you sometimes surprised (good or bad) with the results? I could see how that would impact whether to launch many games or work on the ones you truly believe in.

Barak: We always have intuition, and I can say that, usually, intuition is right. When you have a great game, you immediately know it. That said, however, we find from time-to-time surprises and let’s not forget we are working in a team and when every person has a different view it’s better to try and see how the market responds rather than who makes the best argument.

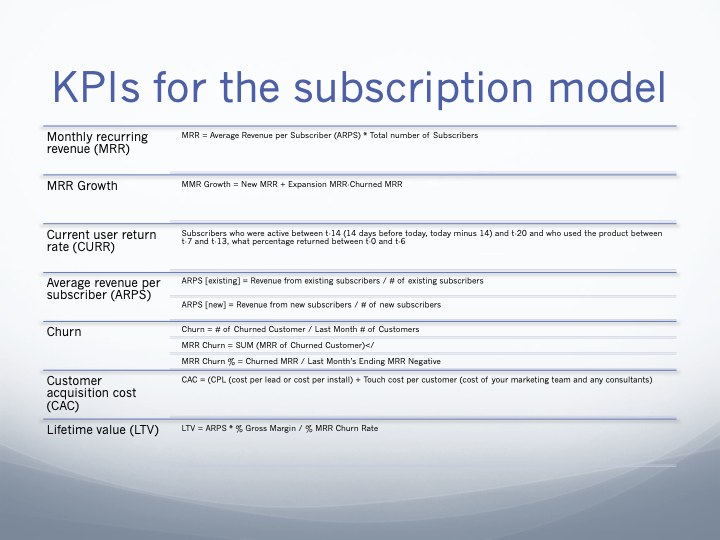

Lloyd: In terms of market response, what KPIs do you focus on? Are they different at launch than as the game matures?

Barak: We are usually focusing on CAC (customer acquisition cost), retention, ROI, and payback on the high level. As virtually any social game company, we have much deeper KPIs we analyze to understand the user behavior and improve their game experience.

Lloyd: What KPIs do you use for CAC and retention? Also, how do KPIs in casual differ from what you experience in social casino?

Barak: The KPIs are different from the social casino as it’s not a whale-based economy, it’s based on the wide audience that engaged with the game and mostly watches ads to continue playing. Retention is different between games and the CAC are relatively much lower than in social casino as the user base is less niche.

Lloyd: Jumping over to a current event, has your CAC, or even your casual revenue, been impacted by the iOS changes?

Barak: The interesting fact is that it didn’t, we build all our waterfall strategies based on knowing that the change will come. I can say that we were less impacted than expected.

Lloyd: That’s great news.

Barak: Absolutely.

Lloyd: Where do you see your casual initiative leading?

Barak: At Murka, we worked extensively to craft a strategy that is based on our core knowledge and expertise and based on that and the vision where we want to see the company in 2-3 years. Therefore, we started to develop in-house casual games, together with looking in inorganic opportunities in the space.

In the first stage we are focusing on small casual companies that will contribute to our expansion in the field.

If that continues to work, we might expand publishing, it is too early to say.

Lloyd: We are running out of time. If there was only one piece of advice you could give companies looking at the casual game space, what would it be?

Barak: Based on the knowledge you already have, try to start simple with small steps to build confidence, don’t hesitate to innovate and always try to improve and create.

Lloyd: Great advice. Thanks so much for your time, Barak, hopefully we can have another conversation soon.

Barak: Thank you Lloyd, I would love to!