I am speaking at the PDMA Inspire Innovation conference later this month if any of you are attending. I would love to meet up and happy if you joined my talk: Digital Product Development Strategy: Maximizing Success Through Strategic Prioritization.

I am speaking at the PDMA Inspire Innovation conference later this month if any of you are attending. I would love to meet up and happy if you joined my talk: Digital Product Development Strategy: Maximizing Success Through Strategic Prioritization.

While my friends and colleagues are very supportive of my decision to pursue a doctorate, the question of why comes up frequently. Given my business and industry experience, a school of thought is that there would be minimal returns on what will be a huge time investment. That idea, however, greatly undervalues both the professional and personal benefits from constantly learning.

Everyone, despite experience, intelligence or past success needs to push themselves forward not only to improve but also to stay relevant. Several years ago, one of my most “controversial” posts was about keeping current to stay valuable. In it, I argued if you do not keep you skills up to date, you can find yourself a dinosaur professionally when you are 30.

While many people lament what they see as age discrimination, the reality is that some great, experienced people, have skills that are no longer valuable. This is not necessarily a factor of age, a 28-year-old user acquisition specialist who is an expert at Facebook marketing could find themselves irrelevant because of limited understanding of the influencer space. Where age often comes into play is that as people get more experienced, they start to believe they can stop learning. Thus, they may be less likely at 50 to take an intro course than they were at 20.

Not only are technologies continuously evolving, so are best practices. Management, marketing and the other “soft” business skills are very different today than ten or twenty (or even five years ago). Look at sports, when you watch a basketball or American football game from 10 or 20years ago, it is a very different event than a game today. It might be how basketball players focus on isolation and three-point shooting versus dominating in the paint with a big center and a coach who was great in 2005 might not know how to coach a team today effectively.

Business is the same. What works best is different today than 2010. The players are different and have different expectations. Even if you are a great coach that won the Super Bowl in 2005, you might be very disappointed in results today if you do not evolve your style. Thus, the best coaches are watching tape and learning from what is happening at the college level and what is happening in different countries.

You need to do the same, learn what is working in adjacent or entirely different industries as well as what other companies in your space are doing. You need to learn or else you will find your business behind or risk getting replaced with someone who is more current on best practices.

The other reason to perpetually learn is more difficult to quantify but equally important, challenging your mind helps you grow as a person and become happier. If you are not learning, you are dying. Learning challenges your mind and helps it develop, while the lack of new stimulus does the opposite. We all push ourselves at work but that is largely limited to 8-10 hours a day, and probably not every day of the week. Those other hours also hold their challenges. However, as we gain experience, these challenges, both at work and home, become increasingly rote. It may not be easy but there is a sense of déjà vu.

Learning breaks that routine. Learning is a process, by definition, you are acquiring knowledge you do not already have. Rather than letting your mind slowly decay, you are expanding your awareness, still growing. Again, this is as important for a 25 year old as a 75 year old, in both cases you can grow or you can slowly decay.

Everyone has different interests and needs. There is no one size fits all way to continue growing your competitive business capability or evolving your intellect. The key, though, is determining what is the best path for you and pushing yourself forward.

After 500+ blog posts, I have decided to pivot my blog in a slightly different direction. While I will continue to write about newsworthy items in the gaming space, over the next three years I will primarily document my learnings and journey as I pursue a DBA (Doctor of Business Administration). I recently started the DBA program at Grenoble Ecole de Management, a three-year program that I will be doing in addition to my full-time job. I will use my blog to share both the key learnings from my research as well as insights into pursuing a DBA.

As part of the DBA, my research will focus on how tech companies prioritize new, innovative projects, particularly those that appeal to a new market (Blue Ocean). As these projects are new and unique, building projections and a P&L is more guesswork than science. In my experience, there is never a lack of great ideas for new projects but there is very little methodology around how to prioritize and which to greenlight. Many projects proceed due to a persuasive champion (or get killed for lack thereof) rather than actual data, very similar to how baseball operated in the pre-Moneyball days. The spreadsheets people build to “scientifically” determine ROI are so filled with assumptions, given that they are looking at a virgin space, that they are less than useless.

In addition to the traditional hurdles in prioritizing new, innovative projects, the evolving state of the industry adds a new challenge. I will layer on to my research how the Metaverse will impact the gaming space and what we should be building. While I am far from an expert currently on the Metaverse, so are the so-called experts (I’m looking at you Zuck). Rather than wild claims, I will break down how the key drivers around the Metaverse and how they will impact our business.

Overall, I plan to use my DBA research to advance the practice of prioritizing new games and technology projects and help everyone commit resources to best satisfy customers (current and future). As I learn best practices and new techniques, I will share them here for those who are interested.

While I have paused new blog posts until the Fall (coming up with new material), I recently had an opportunity to speak with a colleague into what is evolving as the most promising growth area in the gaming space, casual gaming. Barak David, CEO of Murka Games, chatted with me about an often neglected sector in the gaming space that has helped fuel Murka’s recent growth.

Lloyd: Hi Barak, thanks for joining me today, excited to be speaking with you. First, congratulations on the success Murka is enjoying, it is quite exciting. I was hoping today to talk about an area of the gaming space that you recently expanded into, Casual. Would you mind explaining exactly what are casual games and why you expanded Murka’s business into this area?

Barak: Hi Lloyd, happy to be here and speaking with you! Murka traditionally has focused on social casino games like slots and poker. When I joined Murka a couple of years ago, I realized we had great talent, experience, and knowledge at the company. While investing more to expand in social casino, I was confident we could diversify into other areas and appeal to more gamers based on our knowledge.

Lloyd: Why casual? And what are casual?

Barak: Casual games are a very wide segment of the business that is divided into many sub-segments like cards, puzzle, match-three and more. They are often skills based games with a very wide audience. Casual games are fast to develop and will offset the “less strong” points for a traditional social casino company.

We choose at Murka to focus on simple and fun puzzle, words and cards games that are based on advertising monetization and have a very wide audience, the perfect match for us.

Lloyd: Interesting, how are these games different than what would be considered hyper-casual?

Barak: Hyper-casual is an interesting genre; the difference is in the idea to execution. Hyper-casual games are lightweight games with relatively simple game play and mechanics, while casual games are more long term games (they often have a player lifetime of over a year), they have a stronger and longer game loop. Hyper-casual games are built without a specific audience, different from casual and other genres. another very important point, most of the hyper games have very short lifetime

Lloyd: Why did you decide to go with casual instead of hyper-casual at Murka?

Barak: The jump from making a social casino to casual was not trivial but better suited to our skillset than hyper-casual. Compared to other companies, we started by doing it organically. The change in the mindset from social casino, which takes a year to develop and has a very long lifetime, to hyper-casual is too big. Moreover, from the sustainability of the business, it’s much better to have reliable casual games that continue growing than short term hits with hyper casual. Also, in my industry experience, I am much more confident about casual continuing its huge growth trajectory.

Lloyd: So in Murka’s case, what type of games have you built and plan to build? You said earlier that the category is broad, how are you attacking it?

Barak: When entering the space, we did market research, looked at trends, and established a casual innovation group internally to decide what concepts to try initially. Currently, we are very strong in the card game genres (solitaire) with more interesting products that will soon be introduced. We have also been very successful with word games (a great educational and fun experience for the players) and Tetris/Sudoku games that are fun to play anytime. As we are learning and gaining more, we are expecting to introduce more and more games.

Lloyd: Going into a little more detail on the games, how many people do you usually need to build a game, how long does it take and do you leave a Live Services team (or person) on after launch?

Barak: That depends on the technology you are using and the complexity of the game. At Murka, we have built a very strong and scalable platform that we base all the casual games on. This platform helps us use the same modules in different games and dramatically improve the time to market. This gave us a possibility to release four casual games in different genres in the last six months.

So, to answer your question, from idea to execution 6-8 weeks and, yes, we continue to improve the games until a level we believe our players have a greater game experience.

Lloyd: That brings me to my next question, how do you make money with casual games? Is the business model the same as social casino?

Barak: The business model is very, very different. You start with different and unique UA techniques and much lighter monetization comparing to social casino or core games. Moreover, in Murka we decided to focus on advertising monetization rather than in-app purchases.

Lloyd: So most of the revenue comes from ads?

Barak: Yes, this is not always typical for casual but that was the decision we made when entering the space.

Lloyd: That makes sense, have your results confirmed these expectations?

Barak: Absolutely, I can say that from the moment we started to invest in the casual in a professional way and developed in-house knowledge we see very strong results and quick paybacks. For example, the DAU of our casual games has grown 15X since the beginning of the year.

Lloyd: What has surprised you most about the space?

Barak: That’s a very good question. I was very confident about trying to get into this market but it was not always easy to onboard everyone with the idea. Wehad so much success with social casino, it is hard to justify creating a second vertical. For me, it was very good to see how quickly we developed an expertise and learned how to create more and more games based on the same set of rules.

Lloyd: I remember I was one of those skeptics. would you doing anything differently knowing what you know today?

Barak: Maybe start even earlier 🙂 but mostly I think we build this activity step by step, create good games and expertise and confidence and after start ramping up. Overall, I’m very happy with what we have done and how we have accomplished it.

Lloyd: Would you recommend focusing on more games fast or spending a lot of time on a few games?

Barak: That is the question we debate all the time, on one hand if you have a very strong and scalable game you should focus on it and grow it. On the other side, do we want to have several titles and diversify, decreasing the risk and then scale more by number of titles.

It also depends on the capacity of the team, so I would say that need to judge every case separately by himself but my intuition suggests diversification.

Lloyd: Along those lines, have you found in casual that the games you expected to work have been your best performers or are you sometimes surprised (good or bad) with the results? I could see how that would impact whether to launch many games or work on the ones you truly believe in.

Barak: We always have intuition, and I can say that, usually, intuition is right. When you have a great game, you immediately know it. That said, however, we find from time-to-time surprises and let’s not forget we are working in a team and when every person has a different view it’s better to try and see how the market responds rather than who makes the best argument.

Lloyd: In terms of market response, what KPIs do you focus on? Are they different at launch than as the game matures?

Barak: We are usually focusing on CAC (customer acquisition cost), retention, ROI, and payback on the high level. As virtually any social game company, we have much deeper KPIs we analyze to understand the user behavior and improve their game experience.

Lloyd: What KPIs do you use for CAC and retention? Also, how do KPIs in casual differ from what you experience in social casino?

Barak: The KPIs are different from the social casino as it’s not a whale-based economy, it’s based on the wide audience that engaged with the game and mostly watches ads to continue playing. Retention is different between games and the CAC are relatively much lower than in social casino as the user base is less niche.

Lloyd: Jumping over to a current event, has your CAC, or even your casual revenue, been impacted by the iOS changes?

Barak: The interesting fact is that it didn’t, we build all our waterfall strategies based on knowing that the change will come. I can say that we were less impacted than expected.

Lloyd: That’s great news.

Barak: Absolutely.

Lloyd: Where do you see your casual initiative leading?

Barak: At Murka, we worked extensively to craft a strategy that is based on our core knowledge and expertise and based on that and the vision where we want to see the company in 2-3 years. Therefore, we started to develop in-house casual games, together with looking in inorganic opportunities in the space.

In the first stage we are focusing on small casual companies that will contribute to our expansion in the field.

If that continues to work, we might expand publishing, it is too early to say.

Lloyd: We are running out of time. If there was only one piece of advice you could give companies looking at the casual game space, what would it be?

Barak: Based on the knowledge you already have, try to start simple with small steps to build confidence, don’t hesitate to innovate and always try to improve and create.

Lloyd: Great advice. Thanks so much for your time, Barak, hopefully we can have another conversation soon.

Barak: Thank you Lloyd, I would love to!

I have started converting my favorite posts from this blog to Podcasts, using a text to voice engine. You can access the podcasts on multiple sites if you prefer to listen:

Last year, I had the opportunity to attend (virtually) the The Peter Drucker Institute’s Forum on Leadership. What I found particularly compelling (and why I attended) was that the majority of the speakers were successful business leaders, rather than people whose primary calling was providing advice. I always prefer proven actions to theories.

Below, I am highlighting some of the key highlights and takeaways for companies in the gaming space, particularly tied to innovation, leadership, remote work and leading during a crisis.

One of the most interesting lessons from the seminar was a story from Scott Cook, founder and CEO of Intuit, recalling one of Clayton Christensen’s (the guru of innovation) experience with innovation at Intel. According to Cook, Christensen identified spreadsheets as the root cause of Intel’s inability to innovate. He had been brought in by Andy Grove to help Intel and was given access to all new businesses that Intel had created. At the time, Intel had launched 60 new business initiatives, and every single one failed.

As Intel was a huge company, there was robust documentation for all the initiatives. Christensen reviewed the documents and found that the common flaw was the spreadsheet. Whatever the company’s required IRR (internal rate of return) in the proposal, the P&L always showed you would get that IRR. Yet, in the end, all 60 had failed. The spreadsheets actually focused the teams on manipulating the numbers rather than finding product/market fit. This lesson resonated strongly with me, as I have seen many companies in the gaming space try to use robust analysis to greenlight new game projects and the reality never came close to the spreadsheet (in fact, the performance of the projects seemed uncorrelated to the projections).

Key takeaway: Using spreadsheets to analyze a new business venture is worthless or even creates negative value. It is impossible to predict accurately the new ventures performance and takes away from testing businesses in the wild.

While spreadsheets are not the solution to innovating, several speakers provided excellent guidance. One speaker provided a clear alternative to Intel’s failed strategy of innovating by financial analysis. Rather than try to pick winners, admit you do not know what projects will succeed. In stark contrast to Intel, Bosch invested in 200 projects in two years. It gave each a small amount of seed investment. After three months, the teams had to prove the project had traction, using predetermined KPIs. After three more months, the team again had to prove it had promise; at this stage Bosch kills 70 percent of projects, with the others receiving additional investment. After another three months, it kills another seventy percent of projects, adding to the investment in the survivors.

Howard Yu, the LEGO professor of Innovation at IMD Business School explained that companies have no trouble trying disruptive innovation but scaling it. This problem is one I experienced in multiple large companies that were trying to expand into new areas.

These projects turn into side hobbies and never impact the core business, moreover, they leave the company vulnerable to disruption. I once joked that an effort I led at a big company had the promise of being a footnote on its financial statements after five years if we continuously outperformed our plan.

Even when buying companies for innovation, companies often fail to scale this disruption. To overcome this situation, the leadership team must have a shared vision of the future. They and their Board needs to have difficult conversations, including firing and hiring. Most importantly, the CEO has to have a curious mind and recognize what kind of world we live in to capitalize on opportunities and mitigate the biggest risks. A great example of a “curious” executive is Bill Gates, who reads over 50 books a year.

Key takeaways: The best way to grow innovation is testing multiple initiatives, evaluating them critically, stopping the majority of projects and then increasing investment in those showing traction. For a company to innovate and not simply play at innovation, it also needs a curious leader who builds a shared vision of the future.

Another great insight came from Kevin Nolan, the CEO of GE Appliances. GE Appliances is the fastest growing appliance business in North America and owned by Haier, the Chinese conglomerate known for innovation. Nolan discussed his experience at GE Appliances, where the company was originally built on efficiency and productivity but had been dying slowly due to slow moving ideas and bureaucracy. In the fast evolving consumer appliance environment, GE needed to be creative and nimble but instead had become bureaucratic. Ideas were based on the weight of PowerPoint presentations rather than product/market fit. Success was measured on getting into next year’s budget. GE was slow moving and not responsive to the market, unable to compete in a fast paced, short cycle business. Thus, GE sold the unit to Haier, though Nolan expected more of the same from the new Chinese owners.

Instead, Haier realized that employees want to be entrepreneurs. It broke the business into small pieces so it could focus on agility and competition. Haier preached that the only person employees should listen to is the users, they pay the salary, not the company. The philosophy being that your boss is not inside your company but outside, your consumer. Nolan said, “burn your org charts, they represent hierarchy, bureaucracy.”

It broke company down from 4 to 14 product lines and shifted to micro-enterprises. By micro-enterprises, business lines or products that had full P&L responsibility and autonomy. Effectively, GE created a collection of CEOs. The idea behind the micro-businesses is that the team needs to live in a zero distance world from its customer. Every micro-enterprise looks at their individual customers, not the aggregate customers of the company.

The goal for Nolan and Haier was to get zero distance between the customer and employees, perpetually getting the gap smaller and smaller. It was also critical for every micro-business to get tight with its commercial team. That is where got actionable feedback, not one of the staff functions. As Nolan said, “finance can’t tell you what you need to do in the future.”

With this strategy of micro-businesses, GE Appliances is now the fastest growing company in the very competitive North American market and the number one smart home company. It also has the highest employee satisfaction rating in the industry.

Key takeaways: In the gaming space, you can set up every product as a micro-business, with P&L responsibility. Give the team autonomy and allow them to focus on the specific customers of their game, rather than the entire company.

Any strong management conference will include interesting ideas about leadership, and this one did not fail to deliver in that area. One of the speakers, John Ferriola, the former CEO of Nucor (a company with over 26,000 employees), explained the concept of the inverted pyramid. According to Ferriola, command and control only works where safety and compliance are critical. Otherwise, a business in the 21st century need to invert the pyramid, based on meritocracy and freedom for the employees.

At Nucor, the CEO (at the time, Ferriola) works for the employees, not the other way around. Nucor believes every leader at every level must lead with a servant’s heart; their job is to take care of their team. The leader’s job is to create an environment where others can succeed and then trust that once they create that environment, the team will do the best thing. No leader can have all the knowledge to make always the right decision, instead leverage the cumulative resources of your team to take the best path of action.

As part of the inverted pyramid, every employee can bring ideas or complaints to the CEO, with the caveat that they need to discuss the idea first with their immediate supervision. Then employee can speak directly to the CEO without any fear of reprisal. All employees had the CEO’s office number, home number and cell phone.

Key takeaways: Rather than building a strict hierarchy, structure your company so the leaders can serve their teams and create an environment where employees are empowered to take the best action.

Once you accept the concept of the inverted pyramid, there are many techniques to empower your employees, who are now at the top of the pyramid. Tracey Davidson, the Deputy CEO of Handelsbanken explains it comes down to fundamentally trusting your colleagues. To achieve this trust, you need to align around a common set of core values; at Handelsbanken they have had the same goal and core values for 50 years. For these goals to be successful, they must be:

Ms. Davidson explained that when people have a clear mandate, they do their best work. At a structural level, trusting employees allowed them to decentralize their organization and treat each branch treated as a mini-business supported by the central business (consistent to the conversation about micro-businesses above).

It was interesting how empowering employees converged with creating micro-businesses. In Handelsbanken’s case, by turning each branch into a micro-business, they did not have to change policies or decisions for people to make decisions in new parts of the bank. Each branch controls its own P&L. The branch decides where it is going to spend, where expenditures are pitched on a peer basis. Branches see that if they control costs well, then every new customer has a bigger impact.

Handelsbanken also gives each branch details on costs so they can set their own pricing. The central branch provides all the costs of capital as well as other costs and the local branch then decides pricing and whether or not to loan to a local customer.

As part of empowering the branches, they have to live with consequences of their decisions. If capital exposure cost goes up with a bad customer, it impacts the branch. Branch performance reflects customer performance, not kicked into a group KPI. This philosophy has helped Handelsbanken consistently outperform its peers.

Another example of empowering your team is from the CEO of Michelin, Florentino Menegaux. Menegaux points out that as the leader you need to suck the stress from the organization and your team and return the energy. Michelin started as a command and control culture but he realized it was contradictory to trying to focus on customers. He needed to realign processes to tap into the collective intelligence and understanding of customer, rather than relying on processes. To make this change, and put employees at the top of the pyramid, he identified three keys:

Menegaux concluded by pointing out that humans collectively are more powerful than a computer but computers allow people to be more human. He suggested we use technology to unleash human potential, rather than measuring 1,000 KPIs.

Key takeaways: To empower your team and move to an inverted pyramid, you need to provide clear and simple goals and allow your employees to figure out the best way to achieve them.

The conference explored another element of leadership, particularly important now, leading in a remote or work from home environment. What made someone a great leader even two years ago may not work now, where you can no longer meet informally with your team or easily observe their day-to-day activities.

Donna Flynn, the VP of Global Talent at Steelcase focused on the emphatic traits leaders now need to develop. She identified three keys to leading successfully in a remote environment:

Flynn also provided some useful, more tactical advice:

Guy Ben-Ishai of Google added additional insights into effectively leading in a work-from-home or remote environment. According to Ben-Ishai, successful remote leadership comes down to maintaining your presence. If you are not present, you cannot really lead. You can achieve this presence with frequent interactions with a broad number of people, even when working remotely. You should insist on taking the time and having periodic check-ins with employees, colleagues and other leaders.

Key takeaways: In a work-from-home or remote work environment, great leaders need to maintain their presence. You can do this with frequent, personal interactions with teammates, employees and other colleagues.

Covid has not only provided a challenge in leading remote workers but it also has presented opportunities for many companies. Great leaders can turn a crisis into an opportunity. To lead effectively through a crisis, you need to think outside the box and focus on your customers.

Sara Mathew the Chair of the Board at Freddie Mac recounted the story of one of her greatest professional successes. She joined Dun & Bradstreet as CFO a week before 9/11, which almost put the company out of business. To deal with the crisis, Ms. Mathew brought in the consulting group McKinsey, who proposed a very draconian process to survive. She was tasked with changing Europe to break even. Customers had lost trust in the brand because of data quality. The team was worn out with the issue, it was all they heard day in and day out. Yet there was still a sense of optimism as employees maintained pride in D&B.

Ms. Mathews tried something revolutionary, collaborating with their top competitor. Her goal was to give access to their technology platform and data and convert it into franchise model. In 18 months, she created franchises around the world for every market except three where they were already number one. Europe moved from a loss to a $100 million profit. Customer satisfaction improved 30 points. D&B’s stock price went from $20 to $80 and Ms. Mathews became CEO.

Ms. Mathews explained that this success, driven by a crisis, was not genius but the result of trying a radical idea. She also highlighted that the idea did not come from the top, it came from a customer.

In addition to the example of Ms. Mathew, Jorgen Vig Knudstorp, LEGO’s Executive Chairman explained how LEGO used the crisis as an opportunity to reinforce its mission. LEGO annually spends about $300 million to promote children with challenges to learn through play. LEGO increased its investment another $100 million during the pandemic for similar initiatives, as the non-profits they work with were facing extraordinary challenges to continue their work. Knudstorp explains that when you are under pressure, it is a good opportunity to put your money where you mouth is.

Key takeaways: To navigate your way out of a crisis, listen to your customers to come up with novel solutions.

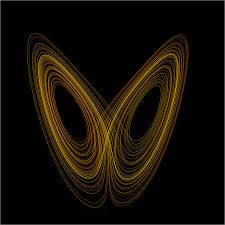

I have written several times recently about the need for resiliency and managing in a complex environment, given how unpredictable the world is and referencing Chaos Theory. Given the importance of the Butterfly Effect, the impact of Chaos Theory, it is worth expounding on the theory and consequences. An article in the MIT Technology Review, When the Butterfly Effect Took Flight by Peter Dizikes, does a great job of explaining the theory and impact.

In the 1960s, Edward Lorenz, a meteorology professor at MIT, entered data into a computer program simulating weather patterns and then took a break while the computer processed the information. Upon reviewing the results, he noticed an outcome that led to what is now known as the Butterfly Effect.

Lorenz’s computer model inputted twelve KPIs, such as temperature and wind speed. During this particular simulation (one that he had run previously), he rounded off one variable from .506127 to .506. Dizikies writes, “to his surprise, that tiny alteration drastically transformed the whole pattern his program produced, over two months of simulated weather. The unexpected result led Lorenz to a powerful insight about the way nature works: small changes can have large consequences. The idea came to be known as the ‘butterfly effect’ after Lorenz suggested that the flap of a butterfly’s wings might ultimately cause a tornado. And the butterfly effect, also known as ‘sensitive dependence on initial conditions,’ has a profound corollary: forecasting the future can be nearly impossible.”

This seemingly innocuous finding challenged some core scientific principles. Isaac Newton published “laws” in 1687 that suggested a tidily predictable mechanical system, known as the “ clockwork universe.” Mathematician Pierre-Simon Laplace whose work was important to the development of engineering, mathematics, statistics, physics, astronomy, and philosophy, wrote that if we knew everything about the universe currently, then “nothing would be uncertain and the future, as the past, would be present to [our] eyes.”

Lorenz’s findings challenged both Newton and Laplace, as unpredictability does not impact how they explain the world. Dizikies explains, “the tiny change in [Lorenz’s] simulation mattered so much showed, by extension, that the imprecision inherent in any human measurement could become magnified into wildly incorrect forecasts…. After Lorenz, we came to see that determinism might give you short-term predictability, but in the long run, things could be unpredictable. That’s what we associate with the word ‘chaos’.”

This concept of chaos amplifies how the world is nonlinear. “The principle of chaos drove home the importance of non¬linearity, a characteristic of many natural systems. If a group of 100 lions has a net gain of 10 members a year, that increase in population size can be plotted on a graph as a straight line. A group of mice that doubles annually, on the other hand, has a nonlinear growth pattern; on a graph, the population size will curve upward. After a decade, the difference between a group that started with 22 mice and one that started with 20 mice will have ballooned to more than 2,000. Given that type of growth pattern, the real-life pressures on species — normal death rates, epidemics, limited resources — will often cause their population sizes to rise and fall chaotically. While not all nonlinear systems are chaotic, all chaotic systems are nonlinear,” explains Dizikies.

A critical element of Chaos Theory is that it does not imply randomness. Dizikies writes, “One way that he demonstrated this was through the equations representing the motion of a gas. When he plotted their solutions on a graph, the result — a pair of linked oval-like figures — vaguely resembled a butterfly. Known as a “Lorenz attractor,” the shape illustrated the point that almost all chaotic phenomena can vary only within limits.” The key here is that the butterfly is a range of possible results, but there are boundaries.

While the effect is not random, it is also not predictable. Nature’s interdependent chains of cause and effect are too complex to disentangle. Thus, you do not which butterfly, or gnat, may have created a given storm.

The value of understanding the Butterfly Effect for gaming companies goes beyond knowing if you need to bring an umbrella to the office. Just as weather patterns are unpredictable due to the myriad of factors that can cause a storm, the business environment is equally unpredictable. A new law in a market you are not engaged or a product launch in a different industry can end up changing the dynamics of your business. The most obvious recent example is how bats in Wuhan, China ended up driving catastrophic effects on the travel (and many other) businesses, while driving online gaming revenue to unprecedented levels.

As the future is not predictable, it is critical that you build a resilient business that can quickly adjust to major changes in your ecosystem. To be resilient and deal with change, you need to move from a hierarchical, command and control structure, to one that empowers your company to react quickly to butterflies half a world away.

A perpetual challenge leaders face is helping their employees without crossing over into micromanaging them. There are many areas that a leader can help his or her team members; they have become a leader because of experience and expertise. This assistance, however, can be counter-productive when it becomes micromanagement and inhibits the employee’s efforts. People have strong negative emotional and physiological reactions to unnecessary or unwanted help and it also can erode working relationships. More importantly, it prevents your team members from displaying their ingenuity.

A recent article in the Harvard Business Review, How to Help (Without Micromanaging) by Colin Fisher, Teresa Amabile and Julianna Pillemer, provides useful advice and techniques to assist in helping your team members while minimizing the negative consequences. The authors point out that this assistance is more important in our Covid-19 environment, especially with complex work that often needs more than just superficial advice or encouragement.

Just as a great athlete waits for the play to develop rather than forcing the action, a great leader watches and listens for when their subordinates see the need for help and are prepared to heed the assistance. This approach is different than the traditional model of trying to anticipate and prevent problems before they develop. As they say in the article, “[Strong leaders] understand that people are more willing to welcome assistance when they’re already engaged in a task or a project and have experienced its challenges firsthand.”

A good approach is to start by listening. Talk to your team about the situation. Ask what is happening and get to the root of the problem. There are multiple benefits to this approach:

Fischer, Amabile and Pillemer worked on this approach with multiple organizations and found substantial benefits. According to them, “we found that when advice was given in the course of teams’ work, after problems had emerged rather than beforehand, members understood and valued it more. This led them to actually use the help, improve their processes, share more information, and make objectively better decisions than did groups that received more instruction at the start of their discussions….[W]e’d counsel managers not to provide input without first allowing those they supervise to gain knowledge of the task and express their views on it. In many cases, a well-timed cure may be better than that ounce of prevention.”

The second key to helping is to clarify your role is to help, not to judge. Many employees will believe that asking for (and getting) advice and help makes them appear vulnerable and weak, potentially putting them in a bad position. They also might believe that having their boss help will lead to them being judged, potentially negatively.

Good leaders will create an environment of psychological safety that encourages interpersonal risks. You should explain that your role is to help, not to judge or take over the work. You need to emphasize continually that the employee is still in charge of the project and that your role is to help make them more effective.

You also need to state clearly that you are not intervening to assess the employee. Fischer, Amabile and Pillemer write, “when managers clarified their intentions … employees were more candid about the problems they faced and more willing to accept help and work collaboratively to solve them. Don’t assume that employees concerned about performance reviews and pay can accurately discern your intentions. No matter how supportive you are as a boss, they won’t forget that part of your job is to monitor and assess them. So when you start taking a stronger hand in their work, assure them that you’re there as an adviser, not an evaluator. Be explicit about what you are trying to accomplish with your intervention.”

Just as you do not want to rush into giving assistance, you also want the situation to drive the cadence and structure of the help you provide. If you jump in and provide help without fully assessing the situation, you are likely to provide sub-optimal guidance. You need to devote sufficient time to understand your employees’ problems. If the issue is complex or creative, you will need to engage deeply. Fischer, et.al. explain, “it … means allocating time and attention in a pattern that works for receivers. We call this the rhythm of involvement, and it will vary depending on whether employees need intensive guidance in the short term or intermittent path clearing over a prolonged period.”

In complex situations, you need to provide concentrated guidance. This help entails working closely with your employees in long sessions tightly clustered over a few days. Given the depth of involvement, you can easily drift into micromanagement. To avoid micromanaging, you need to clarify your role as a helper and ensure your team is ready for the assistance. By taking these steps, your assistance should be welcomed.

If the situation does not require concentrated guidance, your role should be that of a path clearer. In this situation, you offer assistance in shorter, sporadic intervals when employees face ongoing problems. The authors write, “path clearers maintain enough general knowledge about the project to understand emerging needs but seldom dig into the core work. Rather, they look for smaller ways to give relief to their subordinates…. Leaders trying this approach shouldn’t underestimate the importance of staying informed about the work. Those who fail to do so can provide only shallow criticism or vague advice when they drop in.”

By following the three steps above when assisting your employees, your team resolves issues faster while still unleashing their creativity. It also helps you improve your team’s health as they see you as a leader who helps, rather than another problem they need to deal with.

I once wrote that the true measurement of someone you work with (supplier, investor, etc.) is not how they normally act but how they behave in trying situations. The underlying principle is that it is easy to do the right thing when all is going well but you can understand a person’s true character in how they act in difficult times. Many people seem great when they do not have cash flow issues, when their company is hitting or exceeding its targets, etc. They will often talk about win-win relationships and seem fantastic to work with. Then when they have to make hard decisions, they may show they cannot be trusted or relied upon.

I recently came across an article that shows the same analysis can help you assess and improve yourself, You’re Only As Good As Your Worst Day on the Farnam Street blog. The post points out that assessing your performance when challenged is most instructive. They write, “it’s easy to look good when everything goes according to plan and circumstances are calm. Anyone can succeed for a while, even if it’s just out of pure luck. It’s no great feat to do well if you’re not being challenged or tested. Watching what happens during a downswing is far more instructive.”

For leaders, look at how you behave when faced with uncertainty and fear. A weak leader might retreat into their office or become defensive. A strong leader will deal with a difficult situation by bringing everyone together and being a reassuring, sympathetic presence.

People also remember how you act in a difficult situation. They will not focus on how you behaved when you exceeded your numbers or were given a promotion. Instead, what will be most telling is what you did when your product went down for the day or you had a falling out with the CEO. Those are the times when you show them what to model in the future. It is also the time when your team will make decisions whether they are committed long-term.

Behavior on challenging days will tell you (and others) about yourself because it is virtually impossible to fake. As they say in the article, “[i]t’s honest signaling. There’s little time for posturing or stalling. On your worst day, you reveal whether you’ve been planning for the possibility of disaster or just coasting along enjoying the good times. Your plans and preparation (or lack thereof) show how much you really care about the people who depend on you. You get to build and strengthen bonds in ways that will last a lifetime, or you risk destroying relationships in moments. You get to build trust and respect or you might break what you have irreparably.”

Your worst days are priceless. They represent a way to show the people around you your true nature. Most importantly, though, they are a window into yourself. Look back at some of your most challenging times, assess how you reacted, how you treated your colleagues and employees and the choices you made. Learn from these decisions so you can become the leader you want to be.

Last year, the most valuable book I read was General Stanley McChrystal’s Team of Teams and I found his discussion of building an organization to deal with a complex environment particularly useful. The world today is very complex, with events everywhere impacting severely your business, yet most companies are built for a less inter-connected, albeit complicated, world. McChrystal showed that being complex is different from being complicated. Things that are complicated may have many parts, but those parts are joined, one to the next, in straightforward and simple ways. A complicated machine like an internal combustion engine might be confusing to many people but it can be broken down into a series of neat and tidy deterministic relationships. Conversely, things that are complex, such as insurgencies or the mobile gaming ecosystem, have a diverse range of connected parts that interact regularly. Due to this complexity, you need to build a resilient organization that can adapt to changes in the external environment.

Given the importance of resiliency, I then read a book referenced in Team of Teams, Resilience Thinking by Brian Walker. While the book is primarily about resilience in the environment, it lays the groundwork for managing resources in a business and navigating a complex environment.

At its core, resilience thinking is based on the concept that things change and to ignore or resist this change is to increase your vulnerability and forego emerging opportunities. If you do not implement a resiliency strategy, you limit your options. Additionally, Walker points out that business is characterized by dynamic change and it is as critical to manage systems to enhance their resilience, as it is to manage the supply of specific products.

One of the ways that resilience thinking prompts you to take a different approach is by helping you understand the costs of optimization. I have been trained, especially in the gaming space, that the key to success is perpetual optimization (even used that phrase to help sell a company once). We always look for ways to create the most output with the fewest resources, optimize every event in a game based on ABn tests and reduce any “wasted” effort by employees, customers and other stakeholders. Walker says, “humans are great optimizers. We look at everything around us, whether a cow, a house, or a share portfolio and ask ourselves how we can manage it to get the best return. Our modus operandi is to break the thing we’re managing down into its component parts and understand how each part functions and what inputs will yield the greatest outputs.”

An optimization approach aims to get your business into an optimal state and maintain it. Walker explains, “to achieve this outcome, management builds models that generally assume (among other unrecognized assumptions) that changes will be incremental and linear (cause-and-effect changes)…. Ecological systems are extremely dynamic, their behavior much more like the analogy of a boat at sea. They are constantly confronted with ‘surprise’ events such as storms, pest outbreaks, or droughts. What is optimal for one year is unlikely to be optimal the next.” Resilience thinking shows that optimization is not a best-practice as the business ecosystem is usually configured and reconfigured by extreme events, not average conditions.

Walker uses several examples to show how these extreme events actually drive business. Sometimes a competitive product only has a minor impact and at other times it can destroy your business. In some cases a change in interest rate does not impact growth, other times it causes a crash. Resilience thinking is the capacity of a business to absorb disturbances like these and still retain its basic function and structure. Being efficient, by definition, leads to elimination of redundancies as you only keep those activities that are directly and immediately beneficial. Walker writes, “the more you optimize elements of a complex system of humans and nature for some specific goal, the more you diminish that system’s resilience. A drive for an efficient client optimal state outcome has the effect of making the total system more vulnerable to shocks and disturbances.”

The most important takeaway from Walker’s book, and resiliency theory in general, is the importance of thresholds. To understand the need for resilient thinking, the first step is learning about thresholds. In non-business terms, systems can exist in more than one kind of stable state. If a system changes too much it crosses a threshold and begins behaving in a different way, with different feedbacks between its component parts and a different structure. This is not a gradual, linear progression but almost a jump between realities. Think of an airline operating in January 2020 versus their situation in April 2020.

Walker explains how systems, including business systems, shift between thresholds. He uses the analogy of a ball and basin.

System as a Ball in a Basin. The important variables you use to describe a system are known as the system’s “state” variables….

We can envisage the system as a number of basins in two-, or four-, or n-dimensional space…. The ball is the particular combination of the amounts of each of the n variables the system currently has-that is, the current state of the system. The state space of a system is therefore defined by the variables that you are particularly interested in, encompassing the full array of possible states the system can be in.

And it’s not just the state of the system (the position of the ball) in relation to the threshold that’s important. If conditions cause the basin to get smaller, resilience declines, and the potential of the system to cross into a different basin of attraction becomes easier. It takes a progressively smaller disturbance to nudge the system over the threshold. Figures 3 and 4 shows this using the ball in the basin analogy.

If you think of a system as a ball moving around in a basin of attraction, then managing for resilience is about understanding how the ball is moving and what forces shape the basin. The threshold is the lip of the basin leading into an alternate basin where the rules change.

I have seen many examples of this ball and basin philosophy in the business world:

These are all examples where small changes by themselves had negligible impact or even an opposite initial impact, but over time combined they moved the product from one basin to another, causing a tremendous shift in KPIs. Resilience thinking is about looking at the entire ecosystem rather than optimizing one or two events.

This threshold approach shows different ways to approach traditional situations. If the business is stuck in an undesirable “basin”, then it might be impossible or too expensive to manage the threshold or the system’s trajectory. In this situation you may consider transforming the very nature of the system by introducing new state variables (e.g. a subscription model).

You should also consider thresholds when making changes. Walker asks, “how much disturbance and change can a system take before it loses the ability to stay in the same basin?….Along each of these key variables are thresholds; if the system moves beyond a threshold it behaves in a different way, often with undesirable and unforeseen surprises.

Once a threshold has been crossed it is usually difficult (in some cases impossible) to cross back.”

Thresholds also suggest a different way to look at your data and products. You need to understand what thresholds lie along your variables, and knowing how much disturbance it will take to push the system across these thresholds. As Walker says, “to ignore these variables and their thresholds, to simply focus on getting better at business as usual, is to diminish the resilience of the system, increase vulnerability to future shocks and reduce future options…. A system’s resilience can be measured by its distance from these thresholds. The closer you are to a threshold, the less it takes to be pushed….There is a much higher likelihood of crossing a threshold into a new regime if you are unaware of its existence.”

One of the driving forces making resiliency increasingly important compared to efficiency is the complexity of the global business ecosystem, particularly in the gaming space. Walker explains, “we all live and operate in social systems that are inextricably linked with the systems in which they are embedded; we exist within social-ecological systems. Whether in Manhattan or Baghdad, people depend on ecosystems somewhere where for their continued existence. Changes in one domain of the system, social or ecological, inevitably have impacts on the other domain. It is not possible to meaningfully understand the dynamics of one of the domains in isolation from the other.”

2020 drove home the impact of the external environment on many businesses. It is a major component of resilience thinking and an important point of difference with traditional science that has modeled the world based on the assumption that change is incremental and predictable.

Resilience is the capacity of a system to absorb disturbance; to undergo change and still retain essentially the same function, structure, and feedbacks. In cases where you have a particularly successful product or business, this resiliency even more important as you do not want to lose what you have achieved (and success is not easy in the gaming space). Walker writes, “it’s the capacity to undergo some change without crossing a threshold to a different system regime, that is a system with a different identity. A resilient social-ecological system in a ‘desirable’ state (such as a productive agricultural region or industrial region) has a greater capacity to continue providing us with the goods and services that support our quality of life while being subjected to a variety of shocks.“

Resilience thinking is about understanding and engaging with a changing world. By understanding how and why the system as a whole is changing, you can build a capacity to work with change, rather than being at its mercy.

An understanding of what is happening above and below your specific business is critically important. You should ask yourself what effect do these changes exert over the scale in which you are operating. It is also important to identify the key slow controlling variables that may move you between thresholds. While I focused previously on a combination of internal factors that could cause your company to change “basins,” it could also be due to a combination of external factors (e.g. a virus and trade war) or a few of each. Look for, and understand the drivers of slowly changing variables in your ecosystem. Also, simplifying or optimizing the system for increased efficiency reduces diversity of possible responses to disturbance and you become more vulnerable to stresses and shocks.

Given all the variables that impact your business, rather than anticipating each of them, resilience thinking prepares you to recover quickly from shocks. The key to a sustainable business is capacity to recover after a disturbance. While Walker’s book was published in 2006, Covid proved how important it is to be able to recover from existential disturbances.

It is also critical that the ecosystem and the social system are viewed together rather than analyzed independently, and that both went through cycles of adaptation to their changing environments as adaptive cycles happen everywhere.

By adaptive cycles, Walker is referring to two modes, Fore Loops and Back Loops. Walker writes, “a development loop (or ‘fore’ loop), and a release and reorganization loop (or ‘back’ loop) (see figures 9 and 10). The fore loop (sometimes called the front loop or forward loop) is characterized by the accumulation of capital, by stability and conservation, a mode that is essential for system (and therefore human) well-being and …the back loop is characterized by uncertainty, novelty, and experimentation. The back loop is the time of greatest potential for the initiation of either destructive or creative change in the system. It is the time when human actions-intentional and thoughtful, or spontaneous and reckless-can have the biggest impact.”

Resilience is the capacity of the business to absorb change and disturbances and still retain its basic structure and function, maintaining its identity.

The first key to building a company that can navigate the complex and inter-connected world is looking outward, not simply focusing on doing what you are doing now but better. Realize that the future has a habit of throwing up surprises, a product of the complex nature of social-ecological systems.

Rather than try to simulate the future, explore different potential scenarios. Walker writes, “scenarios are not predictions of what will happen. They are an exploration ration of what might happen….Scenarios help organize information, and they are easy to understand. Scenario planning is also a good way to open discussion among different groups of people who might not otherwise interact….For this reason the scenarios should be considered together, not separately. They should be thought of as a set that provides us with a range of insights on what makes a region vulnerable and what confers resilience.”

Second, you should also put resilience thinking into practice. It represents a different way of looking at the world. It’s about seeing systems, linkages, thresholds, and cycles in both what is directly important to your business and in what that drive them. It is about understanding and embracing change, as opposed to striving for constancy.

Third, keep thresholds top of mind. Understand what are the key slow variables that drive your business’ ecosystem and although a small change might not have a negative impact, know that a series of them could push you into another state. Ask whether these variables are changing and what are the thresholds beyond which the ecosystem will behave differently. Thresholds are defined by changes in feedbacks, so understand which important feedbacks in the system are likely to change under certain conditions.

Finally, understand that resilience comes at a cost. It comes down to a trade-off between foregone extra profits in the short term, and long-term persistence and reduced costs from crisis management. Managing for specified resilience is important, but so too is maintaining the general capacities that allow your company to absorb unforeseen disturbances.