Launching new products is vital for the continued success of any game company but surprisingly few have a robust process for prioritizing projects. For a successful game company, new games provide an avenue for growth, as existing games will eventually plateau. Moreover, they mitigate the risk that your current successful game starts to decline.

For a young company or one still trying to make it into the top-tier, new games are even more critical. They provide a mechanism for disrupting the top-10, a new offering that can place you among the top game companies. Without a successful new product, you cannot become a successful company.

While the importance of new games is clear, it is surprising how few companies devote sufficient resources or put much process behind greenlighting projects with the highest ROI. Some of the most metrics driven companies do not use analytics when deciding on new games; they instead count on the intuition of a small circle of executives (or one person). Others start projects without any form of prioritisation. In the worst case, some do not even start new games and have nothing available when their existing products decline.

These companies are not only leaving money on the table, but potentially putting their survival at risk. Everyone has limited resources and by putting resources in the wrong projects, you may miss out on the games needed to survive and thrive.

The game industry in many ways resembles Major League Baseball in Moneyball. Management “knew” what made a good baseball player and used their intuition when building their baseball teams. The entire sport was disrupted when Billy Beane used analytics rather than intuition to build a winning team, with less resources than his competitors.

Since entering the game industry in 1993, and almost always managing limited resources, I have focused on refining the greenlight process so it drives highest ROI. Using lessons from Moneyball, I have identified three steps that lead to optimizing the ROI from new game projects. While you will still have failures (even Billy Beane drafts some busts), you will increase the odds of creating a successful product.

Step 1: Market Data

To determine your new product priorities, you first need to have a deep understanding of your market. A common mistake is to look at the market too high level or focus on your own experiences. In the former case, assume you are a social slots developer. It provides no value to know the gaming market is expected to grow 15 percent next year or even that social casino will grow an average of 8 percent every year for the next five years (both numbers are examples, not actual projections). This type of data is not actionable, it does not help you find market opportunities.

Focusing on your own experience is potentially very misleading. You may have had one product do very well. This experience could create a bias (availability bias) that there is a great opportunity in the market segment where you have done well. The reality might be you filled a niche or provided a superior alternative to the existing top competitor but that there is a very small addressable market and you already dominate it. You will also not see the biggest opportunities in the industry, another company might have launched a comparable product and seen 5X the growth by being in another market segment. If you focus on your experience, you will miss finding the biggest opportunities.

Instead, the best way to look at the market is to focus on your sub-sector, for example social casino, and understand what companies have done well and what companies have underperformed in the past twelve months. The graphic below from an Eilers presentation shows a better way to look at market data:

Using the data above, you would then see what companies grew their market share and where it shrunk. The key to this step in the green light process is to analyse the data to understand where market opportunities exist. In the chart above, Product Madness went from Other to 7 percent share. You then dive deeper and learn that the growth was largely due to their pioneering progressive jackpots, so that feature then represents an opportunity. Conversely, DoubleDown dropped from 12 percent to 9 percent share, so it suggests you should deprioritize building a product that is comparable to DoubleDown’s casino.

Step 2: Blue Ocean

While it is important to understand the market, it is more important to determine Blue Ocean opportunities. The market data, by definition, only shows what you and your competition are doing. Thus, any new products based on this data will be launched into a competitive environment. Moreover, other companies are doing the same analysis, increasing competition in the areas that you have identified.

As I wrote last week, the bigger opportunity is to identify non-customers and bring them into the market. This Blue Ocean strategy has higher returns than focusing on creating a better product than your competitors for an existing market segment.

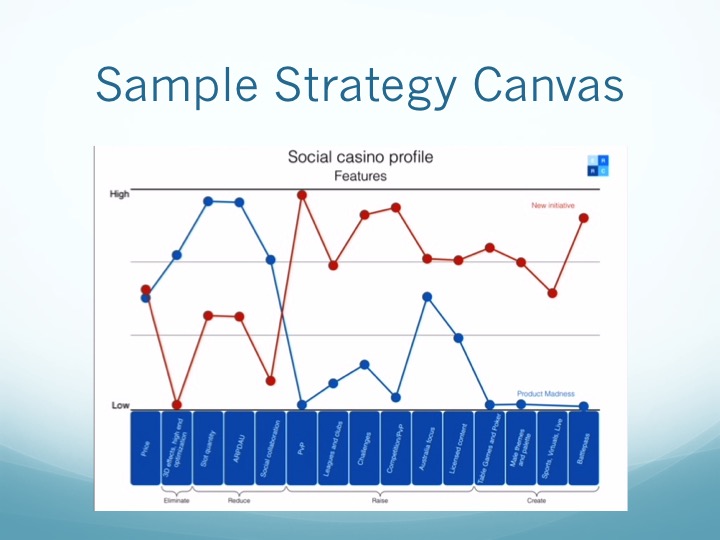

To look for Blue Ocean opportunities, you first need to create a Strategy Canvas. This canvas shows the features existing companies use to compete. You can use it to create a strategy profile that is distinctive from the competition by adding new features to compete on, eliminating some, raising others while reducing some. Below is a hypothetical example of a canvas you would create if you were with Aristocrat’s Product Madness team and looking at a new initiative (you can create these canvases at the Blue Ocean Academy website):

Once you have a strategy canvas, the next phase to building new product ideas is to understand what the canvas shows you should adjust. First, consider what you will add to the product to appeal to non-customers, by both increasing current features and including entirely new attributes.

As you will see above, to compete in a different market space, you first need to reduce (focus less) on some features you and your competitors consider important. Even more challenging, but more critical, is determining what features you will no longer compete on, the ones you will eliminate.

The reduce and eliminate element is as important as deciding what to add or increase and it is much more difficult. Many companies make the mistake of just adding to their product, feature creep. This results in a bloated product that ends up appealing to nobody. It often makes costs too high to justify the new product. It takes discipline to reduce and eliminate but that is the key to building a successful Blue Ocean product.

Step 3: Ideas and Analysis

Once you have completed the first two steps, you integrate the results to prioritize your greenlight process and create a compelling product roadmap. The key is taking the information you have gleaned from the market, the analysis you have done on non-customers (Blue Ocean) and an introspection of your capabilities and combine it to understand your company’s best opportunities.

First, create a SWOT (strength/weakness/opportunity/threat] analysis. Strengths and weaknesses are focused on your company, so it is important to be objective and look at where your company is better or worse than competitors. Opportunities and threats largely comes from the first Steps (market and Blue Ocean analysis), how is the market evolving, why are companies are experiencing growth or declines and what products potentially appeal to non-customers. Below is a sample SWOT analysis:

Following the SWOT analysis, you then brainstorm game ideas that take advantage of your strength and the opportunities while mitigating your weaknesses. There are many great articles on ideation and brainstorming and I will not try to cover it here. At the end of this phase you will have a list of potential products.

The final part of Step 3 is analysing these options to prioritize what products to move forward developing. Without this analysis, all you have are a lot of “good” ideas that different people want to move forward with. To prioritize these opportunities, create a SMART spreadsheet analysis. SMART is an acronym for a Simplified Multi-Attribute Rating Technique.

To create a smart analysis, you first think of all the attributes that impact whether a game will be successful. You start with the meta-categories like virality, retention, monetization, etc., and then identify the sub-attributes in each meta-category (virality could be word of mouth and community). You then weigh each of these sub-attributes on how much they contribute to the overall success of the product, with the total weight equalling 100%. An attribute related to retention could have a weight of 30 percent or a less important attribute like triggers could be 3 percent. You then create a row for each product and give it a score on every attribute from 1 to 10. You multiply that score by the weight of the attribute and sum them up for each product. The products with the highest score(s) should be greenlit while those with a low score should be abandoned. Below is a sample SMART spreadsheet:

The SMART analysis is indispensible as it gives you a prioritized list of projects.

A strong greenlight process will create a strong product pipeline

A good greenlight process is critical to long-term success. It ensures you will have a steady stream of products to gain market share and replace your declining products. After an analysis of industry dynamics and opportunities to bring new customers into the industry, you need to synthesize that information into actionable insights. Creating a SWOT analysis and then SMART spreadsheet allows you to create a prioritized list of projects to focus your development efforts.

Key takeaways

- Launching new games is critical for continued success but very few companies have a strong analytic process for prioritizing projects. By implementing a good framework, you can ensure your team is dedicated to the projects with the highest potential ROI.

- The first two steps to a good greenlight process are understanding the market and uncovering opportunities to turn non-customers into customers. To understand the market, you should look at what competitors are enjoying success and which ones are lagging, then explore why. To identify opportunities to turn non-customers into customers, look at how you can change what the industry competes in by adding, increasing, reducing and eliminating attributes. It takes discipline to reduce and eliminate but that is the key to building a successful Blue Ocean product.

- Once you have a list of potential projects from the industry analysis and review of non-customers, create a weighted spreadsheet (SMART analysis) that weighs the critical success factors and score each product. The products with the highest scores are the ones you should greenlight.