Normally, I take the summer off from writing blog posts but 2020 is anything but a normal year. Unfortunately for many, the pandemic meant you had to cancel or postpone your holidays or had more time to add to your knowledge. Thus, I continued to post but at a slightly reduced schedule. If you were lucky enough to get away, below is a summary of my posts over the summer that you may have missed, enjoy.

Lifetime Value Part 29: Increasing Retention

Key Takeaways

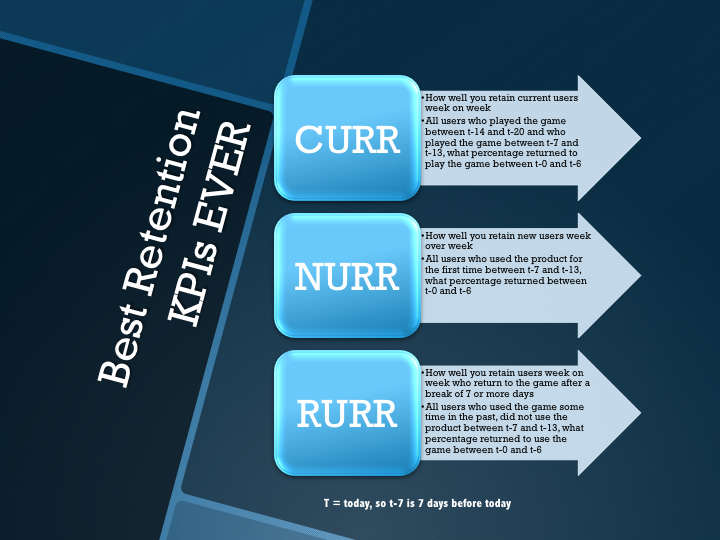

- Retention is the strongest driver of LTV and data from Google shows the most important retention KPI is the amount of players who return on day 2 after installing your game.

- The strongest driver of D2 retention is how many minutes your customers stay/play within the first ten minutes of starting the app.

- To improve retention between the first and second days, make the early experience faster and more fun by improving load times (while reducing secondary loading), making your lobby intuitive, and not distracting your player with a bad tutorial or promotions.

Behavioral Economics Tips for Gaming Companies

Key Takeaways

- A key lesson of behavioral economics is that less choice often drives better results. When the number of choices increases, our ability to make a decision decreases.

- Consumers hate uncertainty. Questions without answers cause fear and kills the experience and sales, it is a customer experience killer.

- Use AB and multi-armed bandit tests help you understand how your players will react in the context of your game, market research conversely might provide bad information as people do not know what they want.

How to avoid meetings about the trivial, aka bikeshedding

Key Takeaways

- Bikeshedding is the tendency we have to spend excessive time on trivial matters in meetings, often glossing over important ones.

- Bikeshedding is damaging because it wastes very valuable time and, more importantly, leads to insufficient discussion of important issues.

- To avoid bikeshedding, set a clear purpose for all meetings (and eliminate conversations about other issues), only invite necessary people, appoint a decision maker and have the decision maker set clear parameters for the meeting.

Lifetime Value Part 30: Why clumpiness should be one of the KPIs you focus on

Key Takeaways

- We normally focus on analyzing recency, frequency and monetization of the customer but by adding a new KPI, clumpiness, we get a much better understanding of their expected value.

- Clumpiness refers to the fact that people buy in bursts and that those customers could be extremely valuable.

- Clumpiness can help you better segment players, predict VIPs and target your reactivation efforts and spend.

Why Evo’s $2 billion+ acquisition of NetEnt is more important (to both iGaming and social casino) than you think

Key Takeaways

- Evolution Gaming, the largest Live Dealer provider, recently announced a bid to acquire NetEnt, the largest slots provider for $2+ billion.

- The deal, in that Evo is the acquirer, shows that Live Dealer is eclipsing slots in the casino ecosystem.

- For real money operators, they need to ensure they balance resources around both Live Dealer and slots while social casino companies need to figure out the best way to embrace this opportunity.

Customer analytics tips for gaming companies

Key Takeaways

- People who wander around a retail location spend more than ones who immediately find what they are looking for and retailers optimize to create this jiggliness. Online casinos and games can also build in jiggliness so players find new games and offerings rather than simply quickly go to the one they are looking to play.

- While satisfaction with customer service positively impacts profitability, the relationship is not linear. Improvements have a strong impact when players are highly dissatisfied (and that is corrected) or when customers with great service make further improvements, companies in the middle often do not see a positive ROI on CS improvements.

- A relationship between two variables does not show one is causing the other, to have causation there must be a relationship plus temporal antecedence plus the absence of a third variable driving both factors.

How to get your big initiatives done

Key Takeaways

- Many important initiatives, from new products to operational efficiency, bog down and die in the middle phase. They initially have momentum but stall once the initial burst dies down.

- To MOVE projects through this middle phase, the Middle element needs a clear and concrete strategy and you need an Organizational structure with capacity to complete the initiative.

- The final keys to getting through the middle phase are Valor, making tough decisions and prioritizing the initiative, and getting Everyone involved.

How Operations Analytics can help online gaming companies

Key Takeaways

- While Operational Analytics are a focus primarily in retail and traditional businesses, there are many best practices that iGaming and social game companies can leverage.

- Forecasting is central to generating and earmarking resources but is often a challenge for game companies, rather than trying to create a point forecast create a range based on moving averages and looking at standard deviation. For new products, create a simulation that will show the distribution of potential outcomes and the risks and rewards possible.

- You need one, and only one, distinct goal and then optimize your strategy around that goal; it’s impossible to optimize for multiple goals. Use constraints to incorporate what used to be additional goals.

The risks of market research

Key Takeaways

- A sole reliance on customer input and feedback, traditional market research, is built on a model of human decision making that assumes humans are rational, while in practice we are not.

- Not only do people provide a response inconsistent with their actions, they often do not understand the underlying causes of their behavior.

- Use one or multiple tools that show actual decision making, such as ABn testing or looking at reactions to similar initiatives in adjacent industries, rather than relying on what customers believe is their preference.